cartoon :D

quick post: just a small cartoon on the current US currency. (i think it looks so cute.)

quick post: just a small cartoon on the current US currency. (i think it looks so cute.)youwen ^^

Anonymous

"When food is short again" (ST, Saturday, April 5 2008)

Monday, April 28, 2008

0 comments

0 comments

Food Shortage (Rise in Food Prices)

Things to take note of:

1) "when the world began consuming more grain than it grew"

(Supply EXCEEDS Demand)

2) "food scarcity is accelerating"

(Scarcity = Limited resources available are unable to satisfy the unlimited human wants)

3) "world grain prices last year alone rose by 42%, and dairy, by 80%"

(An Increase in Demand and Decrease in Supply will cause the equilibrium price to RISE)

Reasons for supply-demand imbalance of grain:

A) Population growth and prosperity in new-rich countries (Increase Demand)

(Changes in Consumer Income is one of the determinants of demand / factors that shift the demand curve. The ability of consumers to buy goods is directly proportionate to their income. Usually, as the income increases, more of a good will be demanded. However, we must also consider that food is income inelastic as one need not consume too much food before feeling satisfied / the rate at which the desire of a good is satisfied as consumption increases is one of the determinants of Income Elasticity of Demand. An increase in income will lead to a less than proportionate increase in consumption of food.)

B) High price of oil (Decrease in Supply)

(This had led to increase in the price of fertiliser that is critical for improving crop yields)

C) Weather disruptions (Decrease in Supply)

(Changes in Climatic Conditions is one of the determinants of supply / factors that shift the supply curve. When there is storm, flood or rain, the supply of agricultural goods will be affected adversely. For example, bad weather conditions will lead to poor harvest for agricultural crops.)

D) Use of considerable amounts of maize and oil seeds to produce biofuels (Decrease in Supply)

(Although this his been beneficial to environment protection, this has led to further food shortages.)

Possible solutions:

i) Using more land for food production

(This method is near impossible due to the lack of land)

ii) Using high-yield strains of rice and wheat (GM food production)

(Genetic manipulation will be able to raise yields per hectare, saving on land area at the same time. However, we should consider the negative medical impacts of excessive consumption of GM food such as allergic reactions and toxicity)

Anonymous

Shocking Economics

Sunday, April 27, 2008

0 comments

0 comments

I dont know about you, but this certainly shocked me.

anyw, the video was posted on 29 Oot, 2007, so some stuffs might not reflect current situation.

love,

Jasmine Kwok

Jasmine Kwok

Sunday, April 27, 2008

0 comments

0 comments

This article is about the rising prices of rice :D

click on the picture to enlarge it if you can't see yah? (:

According to THE NEW PAPER (27th Apr 2008), the supply of rice is decreasing as major rice producing and rice exporting countries start to curb exports.

Thailand, the world's largest exporter, has seen merchants intentionally withholding grains to jack up prices.

Vietnam, the world's third largest exporter imposed a 22% cut in exports, contributing to the rise in prices.

In Bangladesh, the cyclonic weather caused severe flooding and destroyed rice crops in November last year.

With the supply of rice decreasing, price is expected to rise even more and the poor would be the most adversely affected.

with love,

Jasmine Kwok.

Jasmine Kwok

Yochai Benkler: Open-source economics

Tuesday, April 22, 2008

0 comments

0 comments

(http://www.ted.com) Law professor Yochai Benkler explains how collaborative projects like Wikipedia and Linux represent the next stage of human organization. By disrupting traditional economic production, copyright law and established competition, they're paving the way for a new set of economic laws, where empowered individuals are put on a level playing field with industry giants.

That's just a glimpse of the future.

Anonymous

Oil producers reject raising output

Monday, April 21, 2008

0 comments

0 comments

Full Article Here!

(http://www.channelnewsasia.com/stories/afp_world_business/view/342577/1/.html)

1. Increasing Demand for Oil-related products + Scarcity / Factors leading to scarcity such as political unrest, with Oil being a finite resource

'Oil prices hit record highs above 117 dollars per barrel in New York, following a pipeline attack in Africa's biggest producer Nigeria.

Kuwait's acting oil minister said on Sunday that supply and demand factors are not to blame for the soaring price of crude oil, which reached fresh highs last week.

Oil prices hit record highs above 117 dollars per barrel in New York, following a pipeline attack in Africa's biggest producer Nigeria.'

2. OPEC nations still account for two-thirds of the world's oil reserves, and, as of March 2008, 35.6% of the world's oil production, affording them considerable control over the global market.

'Oil-producing countries have rejected calls to raise output amid record prices - five times higher in as many years - saying the rise in demand was artificial.'

'"The level of stockpiles does not currently affect prices on the world market," Mohammad al-Olaim said on the sidelines of an energy forum in Rome attended by oil-producing countries, companies and consumer nations.'

3. OPEC has the aim of ensuring the stabilization of prices / Cartel members may agree on such matters as price fixing, total industry output, market shares, etc.

'Organisation of the Petroleum Exporting Countries (OPEC) president Chakib Khelil, currently touring Kuwait, echoed him, saying there was no need for an immediate hike in production.'

4. Effect of inflation/deflation (US dollar)

'Khelil, on his part, said the falling value of the US dollar was responsible for the surge in oil prices. "When the dollar loses one percent, the price of a barrel of oil rises by four dollars," he said.'

[FYI]

'The next largest group of producers, members of the OECD and the Post-Soviet states produced only 23.8% and 14.8%, respectively, of the world's total oil production. As early as 2003, concerns that OPEC members had little excess pumping capacity sparked speculation that their influence on crude oil prices would begin to slip.'

(http://en.wikipedia.org/wiki/OPEC)

Anonymous

Economic Cartoons

Friday, April 18, 2008

0 comments

0 comments

Economic Cartoons:

due to copyright issues, I am unable to post them on the blog.

Here's the link to it though: CLICK HERE!

My favourites:

1. http://www.cartoonistgroup.com/store/add.php?iid=4826

2. http://www.cartoonistgroup.com/store/add.php?iid=10035

----

Here's a joke to end things off:

"Economists have forecasted 9 out of the last 5 recessions."

Anonymous

news corp and AOL join in microsoft-yahoo fray

Friday, April 18, 2008

0 comments

0 comments

hmm i found something on the microsoft-yahoo merger too.

Basically News Corp is considering joining Microsoft in a bid for Yahoo, which is in talks to merge with AOL.

Effects of merger:

1) Merging of MySpace, Yahoo, Microsoft would result in a very fierce rival to Google as the merger would result in a three-in-one company consisting of an online social networking site, a search engine, and operating systems and web portal services (example: hotmail, MSN)

2) Yahoo to use the Time Warner cash and other funds to buy back several billion dollars worth of Yahoo stocks

>> increase/gain back a larger market share

3) Merger would draw antitrust scrutiny

>> antitrust law: supervising the mergers and acquisitions of large corporations, including some joint ventures. It prevents abusive beahviour by a firm from dominating a market, or anti-competitive practices that tend to lead to such a dominant postion. If Microsoft does get News Corp in on its bid for Yahoo!, the combination of Yahoo!, MSN, and MySpace would indeed act as a formidable competitor to Google.

Basically News Corp is considering joining Microsoft in a bid for Yahoo, which is in talks to merge with AOL.

Effects of merger:

1) Merging of MySpace, Yahoo, Microsoft would result in a very fierce rival to Google as the merger would result in a three-in-one company consisting of an online social networking site, a search engine, and operating systems and web portal services (example: hotmail, MSN)

2) Yahoo to use the Time Warner cash and other funds to buy back several billion dollars worth of Yahoo stocks

>> increase/gain back a larger market share

3) Merger would draw antitrust scrutiny

>> antitrust law: supervising the mergers and acquisitions of large corporations, including some joint ventures. It prevents abusive beahviour by a firm from dominating a market, or anti-competitive practices that tend to lead to such a dominant postion. If Microsoft does get News Corp in on its bid for Yahoo!, the combination of Yahoo!, MSN, and MySpace would indeed act as a formidable competitor to Google.

4) Yahoo to boost revenue by 10%

>> "free up money to invest in stronger businesses" can include adding more services/ functions to its webpages, and hence differentiating its servies from its close competitor, Google. This decreases the substitutibility of Yahoo because of its improved or new range of services. Also, investing in stong businesses would make Yahoo a more stable company because stronger companies are less likely to close down during recessions,etc.

yn

get fuzzy!

Friday, April 18, 2008

0 comments

0 comments

yn

Microsoft + Yahoo = ?

Friday, April 18, 2008

0 comments

0 comments

Click HERE for the full article.

Issue:

Possible merger between Microsoft and Yahoo

Rationale:

"Microsoft is feeling increasing pressure to compete with Google (GOOG), which plans to beef up its portfolio with a $3.1 billion purchase of online advertising company DoubleClick. "

Current Postition:

[Microsoft]

Microsoft currently trails both Yahoo and Google in the lucrative and growing business of Web search.

[Yahoo]

Yahoo has stumbled in recent years with a lack of strategic focus and laggardly technology at a time when Google has been able to monetize its search prowess to a degree that has startled investors.

Fact:

"According to newspaper reports May 4, Microsoft has asked Yahoo to enter formal negotiations for an acquisition that could be worth $50 billion. Yahoo's market capitalization was about $38 billion at the close of trading May 3."

"The deal came after Yahoo and Google said they were having a two week trial of an advertising space-sharing experiment. During the pilot, Google will be able to place ads alongside 3% of search results on Yahoo's website."

"Microsoft threatened to make its offer for Yahoo hostile and to reduce the amount it is prepared to pay if Yahoo's directors did not respond by 26 April." (http://news.bbc.co.uk/2/hi/business/7339992.stm)

Setbacks:

Recently, the shares of Microsoft fell 1.5% to $30.51.

=> Microsoft's falling share price has cut the value of its bid.

(to be continued)

Anonymous

Steven Levitt: the Freakonomics of inner-city gangs

Thursday, April 17, 2008

0 comments

0 comments

"Steven Levitt is an economics professor at the University of Chicago and the best-selling author of Freakonomics. In this talk, filmed at TED2004, he goes inside an inner-city gang to examine economic principles at work in the real world." (Recorded February 2004 in Monterey, CA. Duration: 22:00)

More Here!

Anonymous

vid + comic

Thursday, April 17, 2008

0 comments

0 comments

hmm, kind of found this video tht talks abt money/currency:

>click here to watch<

and here's a comic : DIFFERENTIATION ? lol.

Eileen

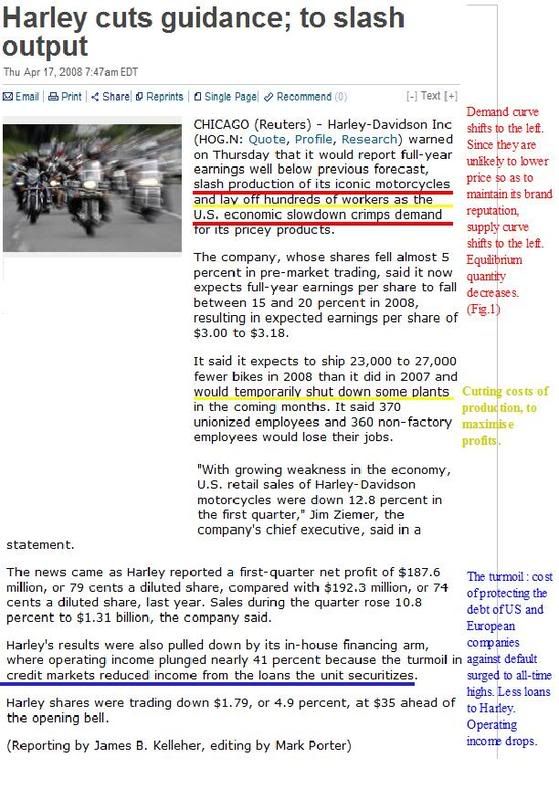

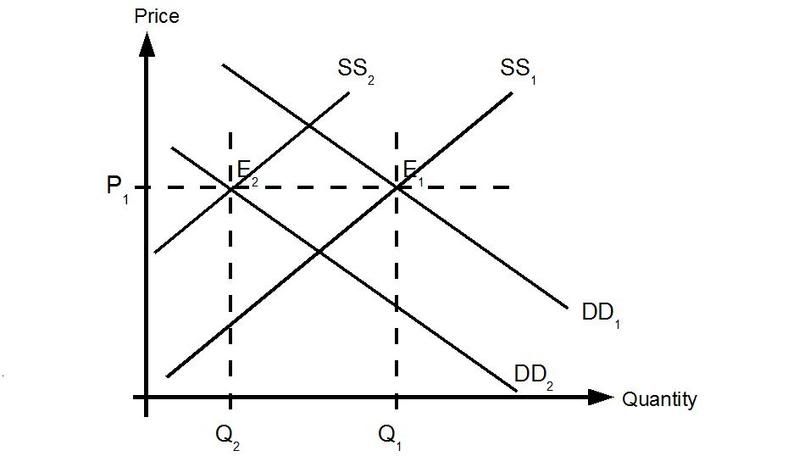

Econs Article : Harley cuts guidance; to slash output

Thursday, April 17, 2008

0 comments

0 comments

Article : (click to enlarge)

Fig 1 : (click to enlarge)

With <3,

Eileen (:

Eileen

Saturday, April 12, 2008

0 comments

0 comments

Hi all,

please contribute to this blog. it's OUR econs blog! =)

yay,

qiu

qiuting

FYI

Friday, April 11, 2008

0 comments

0 comments

1.TASK

Classes' blog entry may include the following:

- Review of interesting economic articles from journals or internet

- Economic jokes/cartoons that illustrate certain economic concepts.

- Video clips depicting certain economic concepts

- Q & A's, "forum-like" postings on views and comments that are economics related among class members

- Any other relevant economics postings that will enhance the class's blog (i.e. ILP work. etc)

- All blog entries need to be original and not a duplicate of any print, otherwise, state the source of the entry and acknowledge the writer/author concerned

- Entries must be suitable for publication (i.e. not obscene, offensive or indecent) and must not have been submitted in other contests or been previously published

- Role of class members: (a) direct involvement in design of blog - template, content, updating and so on. (b) actively participate in the blogging activities

- Content Relevance (Application of Concepts) : 50%

- Active and consistent class participation: 30% (this component of the marks will also contribute to your individual class participation marks which is part of the the Continual Assessment)

- Creative use of multimedia (e.g. flash, music, photographs) : 20%

- Best blog will receive a cash voucher of $200 while next 2 best blog will receive a cash voucher of $100 each

- Results announced on 25 July

ENJOY BLOGGING! :D

Anonymous

Reminder

Thursday, April 10, 2008

0 comments

0 comments

CLASS PARTICIPATION (5%) UPDATE 2008

Descriptor (2%):

Motivated

Prepared for tutorials most of the time

Hardly contribute to class discussions

OR

Not well-prepared for tutorials most of the time

Made consistent effort to contribute during class discussions

HOW TO UP TO 3-3.5%?

o Participate in Econ Blog - at least TWO thorough article

reviews + ONE of the following: video, song, cartoon, jokes, etc all

related to economics.

o Submit your own or in groups ONE entry for Wanted! (which can

be something you used for blog).

o Participate in Online Survey for tutorials and lectures.

BE A MATURE ADULT TO GIVE CONSTRUCTIVE FEEDBACK AND NOT JUST GIVE

JUDGMENT WITHOUT HIGHLIGHTING TO YOUR TUTOR OT LECTURER ON HOW TO

IMPROVE!

HOW TO UP TO 4-5%?

o Have been preparing and contributing in class discussion.

o More than the minimum requirements stated above, be it in terms

of quantity and quality.

Anonymous

0 comments